Featured Media

Stonehage Fleming’s flagship fund passes the $2bn mark

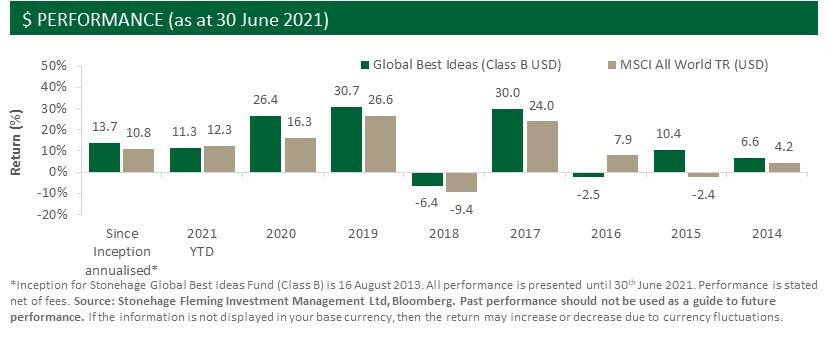

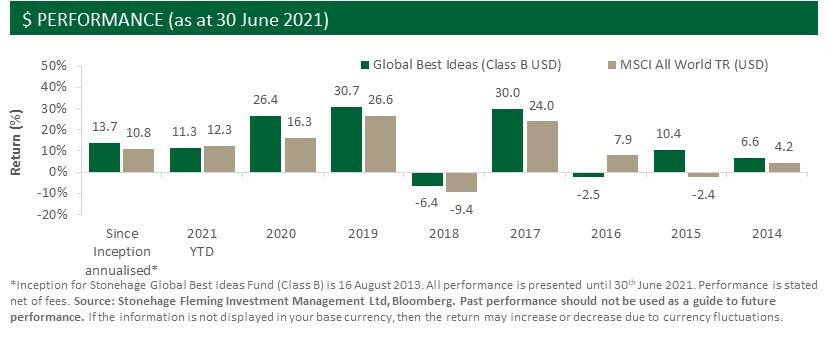

Assets under management (“AUM”) for the Stonehage Fleming Global Best Ideas Equity Fund have passed the USD2bn mark.

Since launching in August 2013, the fund has attracted assets from private, professional and institutional investors. It has returned 118.8% (17.0% p.a.)* over the last five years, compared to the MSCI World’s 97.8% (14.6% p.a.)** (US $ terms)***.

* Source: Stonehage Fleming Investment Management Ltd (SFIM), for period 1 July 2016 to 30 June 2021 (Stonehage Fleming Global Best Ideas Equity Fund (D Share Class) Factsheet).

** Source: MSCI World All Country $ TR, for period 1 July 2016 to 30 June 2021. Source: Bloomberg, MSCI.

*** Past performance is not a guide of future returns. If the information is not displayed in your base currency, then the return may increase or decrease due to currency fluctuations.

Fund Manager Gerrit Smit manages a concentrated, high conviction portfolio of 28 businesses that are chosen for their sustainable growth potential, strong management team, strategic competitive edge and value. The portfolio has very low turnover: over the past 12 months Gerrit has only sold two positions, with the fund turnover well below 10%. Current investments include some of the world’s best known companies such as Amazon, PayPal, Microsoft, Nike, Adobe and Estée Lauder.

Commenting on the current market environment, Gerrit Smit said: “The global fundamental economic recovery for 2021 is well underway, coming off the low base of 2020. We believe we are now into a new positive global economic cycle, well supported by the successful vaccine roll out programmes.”

“Some investors are challenged with perceptions of high valuations. They often underestimate the value of sustainable growth and get overwhelmed by current valuation multiples. The best opportunities lie in strategic investing with an eye on the horizon for long-term compounded growth, combined with an improving short-term outlook.”

Andrew Clarke, Group Head of Business Development said: “In under two years, our Global Best Ideas Equity Fund has doubled in size to exceed 2bn USD. The investment philosophy that underpins the Fund’s strategy, (i.e. that a good business remains a good business irrespective of short-term share price volatility), clearly resonates with investors.

We are excited by the Fund’s growth potential and look forward to raise the Fund’s profile further amongst wholesale investors this year.”

On the continuing impact of Covid-19, Gerrit Smit adds: “PayPal and Amazon (and many others’) futures are in the process of arriving two or more years early, without all the usual necessary investment required to attract all those new clients. Their future profitability therefore also arrives earlier, and their share prices have to reflect that. We believe their future growth trajectory has been enhanced by COVID-19.”

“Whilst the high street is structurally damaged, those businesses that have developed their online capabilities well are in the process of taking permanent market share. They should also enjoy better margins, with direct sales replacing those through wholesalers and retailers.”

Disclaimer:

We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision. Past performance is not a reliable indicator of future results and investments may go down as well as up. All investments risk the loss of capital. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. Where an investment is denominated in a currency other than the currency where the investor is resident, investment returns may increase or decrease as a result of currency fluctuations. The distribution or possession of this article in certain jurisdictions may be restricted by law or other regulatory requirements. Persons into whose possession this document comes should inform themselves about and observe any applicable legal and regulatory requirements.

It has been approved for issue by Stonehage Fleming Investment Management Limited, a company authorised and regulated in the UK by the Financial Conduct Authority and in South Africa by the Financial Sector Conduct Authority (FSP 46194).

Affiliates of Stonehage Fleming Investment Management Limited are authorised and regulated in Jersey by the Jersey Financial Services Commission for financial services business. This document has been approved for use in Jersey.

© Copyright Stonehage Fleming 2021. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming acquires private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces that it has agreed to acquire the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm.

On completion of the transaction, which is subject to regulatory approval in a number of jurisdictions, the business will transfer to Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services capability in 9 locations worldwide. The transaction will add £1 bn of AUM and £15 bn of AUA, taking Stonehage Fleming’s AUM to over £16 bn and AUA to over £60 bn.

Maitland’s Private Client Services business will bring further scale to Stonehage Fleming, strengthen key service areas and broaden the range of jurisdictions offered to clients. It will be combined with and operate under the Stonehage Fleming brand.

Three members of Maitland Group’s management team will join Stonehage Fleming, including Herman Troskie, currently Deputy CEO of Maitland, who will head a new Corporate, Legal and Tax Advisory Services Division at Stonehage Fleming and join the Group’s Executive Committee.

Chris Merry, Stonehage Fleming Group CEO commented: “This is an exciting time for Stonehage Fleming; we have the scale, the range of services and practical wisdom developed over many years to be the partner of choice for successful families and wealth creators. We have known and admired Maitland’s Private Client Services business for many years and are looking forward to welcoming their management, people and clients to Stonehage Fleming.

“For Stonehage Fleming, making selected acquisitions to enhance our proposition and increase our scale as a complement to organic growth is part of our strategic plan. We will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

Steve Georgala, CEO of Maitland commented “This transaction is a key step in the refinement of Maitland’s services offering which is now dedicated to Fund Services and Management Company Services. Such a transaction has been under consideration for some time and Stonehage Fleming has always been our preferred partner. We are confident that this acquisition will provide an excellent home for both our clients and our people who will thrive within a highly regarded global firm focused on the needs of Private Clients.”

Stonehage Fleming was advised on the transaction by Stonehage Fleming Corporate Finance.

FOR FURTHER INFORMATION, PLEASE CONTACT

Stonehage Fleming UK agency: Montfort Communications

Gay Collins/ Pippa Bailey - stonehagefleming@montfort.london

T +44 203 770 7913 M +44 7798 626282

Stonehage Fleming SA agency: CDcom

Claire Densham - claire@cdcom.co.za

T +27 21 552 9935

M +27 82 906 3201

Lucie Osman - lucie@cdcom.co.za

T +27 21 813 6546

M +27 76 763 8259

Maitland UK agency: Aspectus PR

Ellie Smith - maitland@aspectusgroup.com

T +44 20 7242 8867

Maitland SA media contact: Lucy Reyburn

Lucy Reyburn - lucy@lucyreyburn.com

T +27 82 922 7483

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Maitland is a global advisory and administration firm providing seamless multi-jurisdictional legal, tax, fiduciary, investment and fund administration services to private, corporate and institutional clients.

The Group specialise in complex, cross-border solutions, with 780 employees operating from 11 offices across 8 jurisdictions. They are privately owned and fully independent, administering funds for multiple investment managers and sponsors.

Maitland’s reputation in services to corporate clients extends back over 40 years to 1976 when the firm was founded in Luxembourg to provide innovative solutions to complex cross border challenges faced by major corporations. Over the years their legal experts have advised on some of the world’s leading corporate activity, involving both listed and unlisted companies.

Statistics as at end of March 2021

Stonehage Fleming launches first Global Sustainable Equity Fund

Stonehage Fleming Investment Management (“SFIM”) the investment division of one of the world’s leading international Family Offices, announces the launch of its Global Sustainable Equity Fund (“GSEF” or “the Fund”) having successfully launched its Global Sustainable Investment Portfolios (“GSIP”) in 2019.

The Fund will replicate the equity component of GSIP, which has returned 39.42% for the 19 months ending 30th April 2021 versus the global equity benchmark, MSCI ACWI at +23.04% (GBP).

Since launch, the Fund has already attracted over $106 million in assets from private and professional investors demonstrating clear demand for global sustainable equity strategies.

Mona Shah, Director at Stonehage Fleming Investment Management, says: “We strongly believe that today’s portfolio returns should not be at the expense of future generations. The outlook for ESG strategies today is more interesting than at the start of 2020 and we have seen increased appetite for this approach as clients actively seek to demonstrate their social capital in their investment philosophy and measure their positive contribution. By launching the Global Sustainable Equity Fund, we are going some way to meet their demands.”

Graham Wainer, Chief Executive Officer and Head of Investments at Stonehage Fleming Investment Management, adds: “We made the decision that this, our first standalone sustainable investment fund, should be focused solely on equity investments as we see them as the key drivers of return. Our equity investments can tackle a breadth of issues, including building back from Covid-19 and helping to address the majority of the UN’s Sustainable Development Goals. We can also measure and report the impact that our clients’ investments make towards creating a sustainable planet and society.”

Guy Hudson, Partner and Head of Group Marketing at Stonehage Fleming, said: “Our published proprietary research, ‘The Four Pillars of Capital: A time for reflection’ (2020) found that ultra-high net worth families and wealth creators have remained committed to ESG investment, despite the impact of COVID-19. 83% of respondents that applied ESG principles to their investments had not wavered from this, even as the pandemic caused turbulence in markets in the first half of 2020.”

Shah concludes: “Government spending towards the green economy has never been so strong, and the run up to COP26 in November could create a platform for further policy support. Our Global Sustainable Equity Fund is well placed to capture this momentum as well as investment into other social issues, including education and gender equality.”

The Global Sustainable Equity Fund is now available. Further details can be found here: www.stonehagefleming.com/investments/esg

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland / Pippa Bailey

T +44 (0)203 770 7907 / 44 (0)203 770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world.

Statistics as at end of March 2021

This is a financial promotion issued by Stonehage Fleming Investment Management Limited (SFIM) which is authorised and regulated by the Financial Conduct Authority (194382) and by the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No: 46194). The Fund is an approved Foreign Collective Investment Scheme in South Africa and the Management Company, Stonehage Fleming Partners Pooled Investments (Ireland) plc, is registered under the Collective Investment Schemes Control Act, 2002

Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for investment business by the JFSC.

All investments risk the loss of capital.

Past performance is not a guide to future performance.

The Fund intends to invest predominantly in a range of underlying collective investment schemes. Please refer to the prospectus for details of the investment policy.

GSEF has been approved for launch in a limited number of jurisdictions. Before investing you should ensure that the rules in your jurisdiction allow you to buy shares in the Fund.

Stonehage Fleming appoints Head of Estate Planning in newly created role

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Hélie de Cornois as Director and Head of Estate Planning.

Hélie will be based in Stonehage Fleming’s Luxembourg office and will report into Jacqui Cheshire, Partner and Head of Family Office in Switzerland. He will advise ultra-high net worth private clients and investors on a range of domestic and international tax and estate planning matters. This is a newly created role and Hélie’s appointment is effective immediately.

Hélie has over 17 years’ experience in the estate planning industry. Prior to joining the Stonehage Fleming Group in 2021 he was Head of Estate Planning & International Patrimonial Services at Banque Degroof Petercam in Luxembourg, where he was responsible for the Estate Planning department. He was also responsible for coordinating International Estate Planning files for the group and for developing private banking in Southern Europe, Canada and UK. Hélie joined Banque Degroof Petercam in 2007 and held roles including Head of Wealth Structuring and Head of Corporate and Structured Finance in Luxembourg.

Hélie began his career in 2003 at Banque de Gestion Privée Indosuez (now CA Indosuez Wealth) in Paris as an estate planner. He is also a Member of the Society of Trust and Estate Practitioners (STEP) and the Luxembourg Private Equity and Venture Capital Association (LPEA).

Commenting on the appointment, Jacqui Cheshire, Partner and Head of Family Office in Switzerland said: “Continental Europe is a key market for us and so we are pleased to have attracted someone of Hélie’s calibre to bolster our Luxembourg team. This is a newly created role and underlines our commitment to the further growth of the business in Europe and to continually expanding our client service offering. I am delighted to welcome Hélie and look forward to working with him in the coming months.”

Hélie de Cornois said: “The pandemic prompted many people to reassess their plans and priorities – it was a catalyst to get their affairs in order. This is a growing trend and an ideal opportunity for me to help expand Stonehage Fleming’s existing expertise. I am looking forward to working with our families to help find the right solutions in what is a complex and ever evolving arena”.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming’s flagship fund passes the $2bn mark

Assets under management (“AUM”) for the Stonehage Fleming Global Best Ideas Equity Fund have passed the USD2bn mark.

Since launching in August 2013, the fund has attracted assets from private, professional and institutional investors. It has returned 118.8% (17.0% p.a.)* over the last five years, compared to the MSCI World’s 97.8% (14.6% p.a.)** (US $ terms)***.

* Source: Stonehage Fleming Investment Management Ltd (SFIM), for period 1 July 2016 to 30 June 2021 (Stonehage Fleming Global Best Ideas Equity Fund (D Share Class) Factsheet).

** Source: MSCI World All Country $ TR, for period 1 July 2016 to 30 June 2021. Source: Bloomberg, MSCI.

*** Past performance is not a guide of future returns. If the information is not displayed in your base currency, then the return may increase or decrease due to currency fluctuations.

Fund Manager Gerrit Smit manages a concentrated, high conviction portfolio of 28 businesses that are chosen for their sustainable growth potential, strong management team, strategic competitive edge and value. The portfolio has very low turnover: over the past 12 months Gerrit has only sold two positions, with the fund turnover well below 10%. Current investments include some of the world’s best known companies such as Amazon, PayPal, Microsoft, Nike, Adobe and Estée Lauder.

Commenting on the current market environment, Gerrit Smit said: “The global fundamental economic recovery for 2021 is well underway, coming off the low base of 2020. We believe we are now into a new positive global economic cycle, well supported by the successful vaccine roll out programmes.”

“Some investors are challenged with perceptions of high valuations. They often underestimate the value of sustainable growth and get overwhelmed by current valuation multiples. The best opportunities lie in strategic investing with an eye on the horizon for long-term compounded growth, combined with an improving short-term outlook.”

Andrew Clarke, Group Head of Business Development said: “In under two years, our Global Best Ideas Equity Fund has doubled in size to exceed 2bn USD. The investment philosophy that underpins the Fund’s strategy, (i.e. that a good business remains a good business irrespective of short-term share price volatility), clearly resonates with investors.

We are excited by the Fund’s growth potential and look forward to raise the Fund’s profile further amongst wholesale investors this year.”

On the continuing impact of Covid-19, Gerrit Smit adds: “PayPal and Amazon (and many others’) futures are in the process of arriving two or more years early, without all the usual necessary investment required to attract all those new clients. Their future profitability therefore also arrives earlier, and their share prices have to reflect that. We believe their future growth trajectory has been enhanced by COVID-19.”

“Whilst the high street is structurally damaged, those businesses that have developed their online capabilities well are in the process of taking permanent market share. They should also enjoy better margins, with direct sales replacing those through wholesalers and retailers.”

Disclaimer:

We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision. Past performance is not a reliable indicator of future results and investments may go down as well as up. All investments risk the loss of capital. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. Where an investment is denominated in a currency other than the currency where the investor is resident, investment returns may increase or decrease as a result of currency fluctuations. The distribution or possession of this article in certain jurisdictions may be restricted by law or other regulatory requirements. Persons into whose possession this document comes should inform themselves about and observe any applicable legal and regulatory requirements.

It has been approved for issue by Stonehage Fleming Investment Management Limited, a company authorised and regulated in the UK by the Financial Conduct Authority and in South Africa by the Financial Sector Conduct Authority (FSP 46194).

Affiliates of Stonehage Fleming Investment Management Limited are authorised and regulated in Jersey by the Jersey Financial Services Commission for financial services business. This document has been approved for use in Jersey.

© Copyright Stonehage Fleming 2021. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming acquires private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces that it has agreed to acquire the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm.

On completion of the transaction, which is subject to regulatory approval in a number of jurisdictions, the business will transfer to Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services capability in 9 locations worldwide. The transaction will add £1 bn of AUM and £15 bn of AUA, taking Stonehage Fleming’s AUM to over £16 bn and AUA to over £60 bn.

Maitland’s Private Client Services business will bring further scale to Stonehage Fleming, strengthen key service areas and broaden the range of jurisdictions offered to clients. It will be combined with and operate under the Stonehage Fleming brand.

Three members of Maitland Group’s management team will join Stonehage Fleming, including Herman Troskie, currently Deputy CEO of Maitland, who will head a new Corporate, Legal and Tax Advisory Services Division at Stonehage Fleming and join the Group’s Executive Committee.

Chris Merry, Stonehage Fleming Group CEO commented: “This is an exciting time for Stonehage Fleming; we have the scale, the range of services and practical wisdom developed over many years to be the partner of choice for successful families and wealth creators. We have known and admired Maitland’s Private Client Services business for many years and are looking forward to welcoming their management, people and clients to Stonehage Fleming.

“For Stonehage Fleming, making selected acquisitions to enhance our proposition and increase our scale as a complement to organic growth is part of our strategic plan. We will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

Steve Georgala, CEO of Maitland commented “This transaction is a key step in the refinement of Maitland’s services offering which is now dedicated to Fund Services and Management Company Services. Such a transaction has been under consideration for some time and Stonehage Fleming has always been our preferred partner. We are confident that this acquisition will provide an excellent home for both our clients and our people who will thrive within a highly regarded global firm focused on the needs of Private Clients.”

Stonehage Fleming was advised on the transaction by Stonehage Fleming Corporate Finance.

FOR FURTHER INFORMATION, PLEASE CONTACT

Stonehage Fleming UK agency: Montfort Communications

Gay Collins/ Pippa Bailey - stonehagefleming@montfort.london

T +44 203 770 7913 M +44 7798 626282

Stonehage Fleming SA agency: CDcom

Claire Densham - claire@cdcom.co.za

T +27 21 552 9935

M +27 82 906 3201

Lucie Osman - lucie@cdcom.co.za

T +27 21 813 6546

M +27 76 763 8259

Maitland UK agency: Aspectus PR

Ellie Smith - maitland@aspectusgroup.com

T +44 20 7242 8867

Maitland SA media contact: Lucy Reyburn

Lucy Reyburn - lucy@lucyreyburn.com

T +27 82 922 7483

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Maitland is a global advisory and administration firm providing seamless multi-jurisdictional legal, tax, fiduciary, investment and fund administration services to private, corporate and institutional clients.

The Group specialise in complex, cross-border solutions, with 780 employees operating from 11 offices across 8 jurisdictions. They are privately owned and fully independent, administering funds for multiple investment managers and sponsors.

Maitland’s reputation in services to corporate clients extends back over 40 years to 1976 when the firm was founded in Luxembourg to provide innovative solutions to complex cross border challenges faced by major corporations. Over the years their legal experts have advised on some of the world’s leading corporate activity, involving both listed and unlisted companies.

Statistics as at end of March 2021

Stonehage Fleming launches first Global Sustainable Equity Fund

Stonehage Fleming Investment Management (“SFIM”) the investment division of one of the world’s leading international Family Offices, announces the launch of its Global Sustainable Equity Fund (“GSEF” or “the Fund”) having successfully launched its Global Sustainable Investment Portfolios (“GSIP”) in 2019.

The Fund will replicate the equity component of GSIP, which has returned 39.42% for the 19 months ending 30th April 2021 versus the global equity benchmark, MSCI ACWI at +23.04% (GBP).

Since launch, the Fund has already attracted over $106 million in assets from private and professional investors demonstrating clear demand for global sustainable equity strategies.

Mona Shah, Director at Stonehage Fleming Investment Management, says: “We strongly believe that today’s portfolio returns should not be at the expense of future generations. The outlook for ESG strategies today is more interesting than at the start of 2020 and we have seen increased appetite for this approach as clients actively seek to demonstrate their social capital in their investment philosophy and measure their positive contribution. By launching the Global Sustainable Equity Fund, we are going some way to meet their demands.”

Graham Wainer, Chief Executive Officer and Head of Investments at Stonehage Fleming Investment Management, adds: “We made the decision that this, our first standalone sustainable investment fund, should be focused solely on equity investments as we see them as the key drivers of return. Our equity investments can tackle a breadth of issues, including building back from Covid-19 and helping to address the majority of the UN’s Sustainable Development Goals. We can also measure and report the impact that our clients’ investments make towards creating a sustainable planet and society.”

Guy Hudson, Partner and Head of Group Marketing at Stonehage Fleming, said: “Our published proprietary research, ‘The Four Pillars of Capital: A time for reflection’ (2020) found that ultra-high net worth families and wealth creators have remained committed to ESG investment, despite the impact of COVID-19. 83% of respondents that applied ESG principles to their investments had not wavered from this, even as the pandemic caused turbulence in markets in the first half of 2020.”

Shah concludes: “Government spending towards the green economy has never been so strong, and the run up to COP26 in November could create a platform for further policy support. Our Global Sustainable Equity Fund is well placed to capture this momentum as well as investment into other social issues, including education and gender equality.”

The Global Sustainable Equity Fund is now available. Further details can be found here: www.stonehagefleming.com/investments/esg

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland / Pippa Bailey

T +44 (0)203 770 7907 / 44 (0)203 770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world.

Statistics as at end of March 2021

This is a financial promotion issued by Stonehage Fleming Investment Management Limited (SFIM) which is authorised and regulated by the Financial Conduct Authority (194382) and by the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No: 46194). The Fund is an approved Foreign Collective Investment Scheme in South Africa and the Management Company, Stonehage Fleming Partners Pooled Investments (Ireland) plc, is registered under the Collective Investment Schemes Control Act, 2002

Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for investment business by the JFSC.

All investments risk the loss of capital.

Past performance is not a guide to future performance.

The Fund intends to invest predominantly in a range of underlying collective investment schemes. Please refer to the prospectus for details of the investment policy.

GSEF has been approved for launch in a limited number of jurisdictions. Before investing you should ensure that the rules in your jurisdiction allow you to buy shares in the Fund.

Stonehage Fleming appoints Head of Estate Planning in newly created role

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Hélie de Cornois as Director and Head of Estate Planning.

Hélie will be based in Stonehage Fleming’s Luxembourg office and will report into Jacqui Cheshire, Partner and Head of Family Office in Switzerland. He will advise ultra-high net worth private clients and investors on a range of domestic and international tax and estate planning matters. This is a newly created role and Hélie’s appointment is effective immediately.

Hélie has over 17 years’ experience in the estate planning industry. Prior to joining the Stonehage Fleming Group in 2021 he was Head of Estate Planning & International Patrimonial Services at Banque Degroof Petercam in Luxembourg, where he was responsible for the Estate Planning department. He was also responsible for coordinating International Estate Planning files for the group and for developing private banking in Southern Europe, Canada and UK. Hélie joined Banque Degroof Petercam in 2007 and held roles including Head of Wealth Structuring and Head of Corporate and Structured Finance in Luxembourg.

Hélie began his career in 2003 at Banque de Gestion Privée Indosuez (now CA Indosuez Wealth) in Paris as an estate planner. He is also a Member of the Society of Trust and Estate Practitioners (STEP) and the Luxembourg Private Equity and Venture Capital Association (LPEA).

Commenting on the appointment, Jacqui Cheshire, Partner and Head of Family Office in Switzerland said: “Continental Europe is a key market for us and so we are pleased to have attracted someone of Hélie’s calibre to bolster our Luxembourg team. This is a newly created role and underlines our commitment to the further growth of the business in Europe and to continually expanding our client service offering. I am delighted to welcome Hélie and look forward to working with him in the coming months.”

Hélie de Cornois said: “The pandemic prompted many people to reassess their plans and priorities – it was a catalyst to get their affairs in order. This is a growing trend and an ideal opportunity for me to help expand Stonehage Fleming’s existing expertise. I am looking forward to working with our families to help find the right solutions in what is a complex and ever evolving arena”.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

10 May 2021

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

Stonehage Fleming, l’un des plus grands Family Office indépendant au monde, annonce l’arrivée d’Hélie de Cornois au poste de Director et Head of Estate Planning.

Hélie sera rattaché au bureau de Stonehage Fleming situé au Luxembourg, et rapportera à Jacqui Cheshire, Partner et Head of Family Office en Suisse. Il accompagnera les clients et investisseurs ultra-high net worth sur des sujets d’organisation patrimoniale et de fiscalité nationale et internationale. La nomination d’Hélie à ce poste nouvellement créé est effective immédiatement.

Hélie a plus de 17 ans d’expérience dans le domaine de l’ingénierie patrimoniale. Avant de rejoindre le groupe Stonehage Fleming en 2021, il était Head of Estate Planning & International Patrimonial Services à la Banque Degroof Petercam au Luxembourg, où il avait la responsabilité du département d’ingénierie patrimoniale. Il était également en charge de la coordination des dossiers patrimoniaux internationaux pour le groupe et du développement de la Banque Privée en Europe du Sud, au Canada et au Royaume-Uni. Hélie a rejoint la Banque Degroof Petercam en 2007, où il a été notamment Head of Wealth Structuring et Head of Corporate & Strucured Finance au Luxembourg.

Hélie a commencé sa carrière en 2003, à la Banque de Gestion Privée Indosuez (maintenant CA Indosuez Wealth) à Paris, en tant qu’ingénieur patrimonial. Il est aussi membre de la Society of Trust and Estate Practitioners (STEP) et de la Luxembourg Private Equity and Venture Capital Association (LPEA).

Au sujet de cette nomination, Jacqui Cheshire, Partner et Head of Family Office en Suisse, ajoute : « L’Europe continentale est un marché clé pour nous et nous sommes donc ravis d'avoir attiré quelqu’un du calibre d’Hélie pour renforcer notre équipe au Luxembourg. Ce nouveau poste souligne notre volonté de nous développer en Europe et de continuellement compléter notre offre de services pour nos clients. Je suis heureuse d'accueillir Hélie et je me réjouis de collaborer avec lui dans les prochains mois. »

Hélie de Cornois précise : « La pandémie a incité beaucoup de gens à revoir leurs projets et leurs priorités ; elle a servi de catalyseur pour organiser leur patrimoine. C’est une tendance croissante qui m’offre l’opportunité de renforcer l’expertise existante de Stonehage Fleming. Je me réjouis de travailler avec nos familles pour les aider à identifier les solutions appropriées dans cet environnement complexe et évolutif ».

POUR EN SAVOIR PLUS, CONTACTEZ

Montfort Communications

Toto Reissland / Pippa Bailey

T : +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming announces appointment of Mario Schoeman

Mario will be responsible for leading the distribution of Stonehage Fleming’s global service offerings, including the award winning Global Best Ideas Equity fund into the South African investment market, directly as well as through the Feeder Fund. He will be based in Stonehage Fleming’s Cape Town office and will report into Andrew Clarke, Group Head of Business Development. His appointment is effective immediately.

Mario has more than two decades of local and international investment industry experience, ranging from fund research and investment product management to retail and institutional business development. He was Head of Retail Distribution at Foord Asset Management for the past 10 years and served on various committees at the Association for Savings & Investment South Africa. Prior to this he was with OMIGSA and STANLIB in executive positions. Mario holds a BSc degree from the University of Stellenbosch as well as a Masters degree in Business Leadership from the University of South Africa.

Commenting on the appointment, Andrew Clarke said: “The Global Best Ideas Equity investment strategy is already well established in South Africa, but we look forward to having a dedicated resource on the ground who has the primary responsibility of growing the AUM of this fund through the wholesale market. We are excited about Mario’s experience in the industry and the role he will play in the distribution of our other premier offerings in the local market. We are delighted to welcome him to the firm.”

Mario Schoeman said: “Stonehage Fleming’s reputation in the industry is flawless and I am honoured to join the team. I am very excited about the team’s capabilities, evidenced in the track record of the GBI strategy and look forward to contribute to even more success.”

Stonehage Fleming announces series of new appointments in Jersey

Stonehage Fleming, one of the world’s leading international Family Offices, announces a series of appointments across its Family Office, Treasury and Corporate Services divisions in Jersey.

The eight new hires follow the recent announcement of Bev Stewart as Director in the Jersey Family Office division (November 2020) and cover various levels of seniority. New joiners include: Miguel Loureiro and Florence Busel in Family Office, Amber Thomas, Marta Szyman, Jarek Wolak and Matthew Bree in Treasury, and Jon Manning and Kay Jeanne in Corporate Services. They are all based in Stonehage Fleming’s Jersey office and their appointments are effective immediately.

The new appointments join an office of over 100 people, with nearly half of the partners having been at the firm for more than 20 years, and many of the senior team considered leading figures in their respective fields on the island.

Commenting on the appointment, Ana Ventura, Partner and Head of Family Office Jersey said: “We are thrilled to welcome so many new faces to our already extremely talented and dedicated team. These appointments reflect and confirm our drive to nurture talent and to provide unrivalled career development opportunities on the island.”

“As we celebrate International Women’s Day, it is equally exciting that we have hired some immensely promising female talent to join our existing group of women who we have supported through the firm’s ranks.”

Cora Binchy, Partner in Stonehage Fleming’s Family Office division said: “I am delighted to welcome everyone to Stonehage Fleming. I have been with the firm for over 30 years and am incredibly proud of the nurturing culture and career development opportunities Stonehage Fleming is able to provide. Likewise, a diverse workforce is essential for businesses and gender parity is a huge part of that. We have seen progress in this area but in a rapidly changing world, we need to accelerate so we are well positioned for the future. I look forward to working with our new colleagues.”

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Pippa Bailey

T: +44 (0)203 770 7913

Stonehage Fleming appoints new client relationship director in UK family office team

01 Feb 2021

Stonehage Fleming appoints new client relationship director in UK family office team

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Doris Sommavilla as Client Relationship Director, in the UK Family Office team.

Doris will draw on her family governance and succession planning experience to advice families on their strategic planning, and work closely with them to co-ordinate their operational requirements. She will be based in Stonehage Fleming’s London office and will report into Roelof Botha, Head of UK Family Office. Her appointment is effective immediately.

Doris joins from Blu Family Office where she was a Principal responsible for providing investment advice on alternative assets and for business development in the UK, Italy, Germany and Monaco. She is a third-generation member of a family business focused on hospitality and residential development in Italy and Eastern Europe, and Non- Executive Director of her family business.

Doris has over a decade of experience in investment management dealing with alternative investments with a focus on distressed opportunities in the UK, Germany, Italy and Eastern Europe. She began her career in institutional asset management, first with Allianz Global Investors in Milano, Italy and then Pimco in Munich, Germany.

Doris is a qualified family officer in Italy and CAIA charterholder, a full Member (MCSI) of the Chartered Institute for Securities & Investment (CISI), and has a Msc in Finance from Bocconi University, Italy. Doris is also the co-founder of Family Hippocampus, a global network of family members, and ambassador of the women chapter of Leaders First, a global membership organisation.

Commenting on the appointment, Roelof Botha, Head of UK Family Office, said: “It is a pleasure to welcome Doris to Stonehage Fleming. She has extensive experience in a wide range of Family Office services, including Family Governance and Succession matters, and has an impressive network of family relationships throughout the UK and Continental Europe, including in particular her native Italy. Her appointment demonstrates our commitment to the further growth of the business, and our ambition to lead the industry in the provision of services that support multigenerational families and wealth creators.”

Doris Sommavilla, said: “I have known Stonehage Fleming for many years, and admire its company culture and family-centred approach which sits at the core of the Group. I am passionate about helping families plan for succession and become resilient now and for future generations, and look forward to working with the team.

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

Stonehage Fleming, l’un des plus grands Family Office indépendant au monde, annonce l’arrivée d’Hélie de Cornois au poste de Director et Head of Estate Planning.

Hélie sera rattaché au bureau de Stonehage Fleming situé au Luxembourg, et rapportera à Jacqui Cheshire, Partner et Head of Family Office en Suisse. Il accompagnera les clients et investisseurs ultra-high net worth sur des sujets d’organisation patrimoniale et de fiscalité nationale et internationale. La nomination d’Hélie à ce poste nouvellement créé est effective immédiatement.

Hélie a plus de 17 ans d’expérience dans le domaine de l’ingénierie patrimoniale. Avant de rejoindre le groupe Stonehage Fleming en 2021, il était Head of Estate Planning & International Patrimonial Services à la Banque Degroof Petercam au Luxembourg, où il avait la responsabilité du département d’ingénierie patrimoniale. Il était également en charge de la coordination des dossiers patrimoniaux internationaux pour le groupe et du développement de la Banque Privée en Europe du Sud, au Canada et au Royaume-Uni. Hélie a rejoint la Banque Degroof Petercam en 2007, où il a été notamment Head of Wealth Structuring et Head of Corporate & Strucured Finance au Luxembourg.

Hélie a commencé sa carrière en 2003, à la Banque de Gestion Privée Indosuez (maintenant CA Indosuez Wealth) à Paris, en tant qu’ingénieur patrimonial. Il est aussi membre de la Society of Trust and Estate Practitioners (STEP) et de la Luxembourg Private Equity and Venture Capital Association (LPEA).

Au sujet de cette nomination, Jacqui Cheshire, Partner et Head of Family Office en Suisse, ajoute : « L’Europe continentale est un marché clé pour nous et nous sommes donc ravis d'avoir attiré quelqu’un du calibre d’Hélie pour renforcer notre équipe au Luxembourg. Ce nouveau poste souligne notre volonté de nous développer en Europe et de continuellement compléter notre offre de services pour nos clients. Je suis heureuse d'accueillir Hélie et je me réjouis de collaborer avec lui dans les prochains mois. »

Hélie de Cornois précise : « La pandémie a incité beaucoup de gens à revoir leurs projets et leurs priorités ; elle a servi de catalyseur pour organiser leur patrimoine. C’est une tendance croissante qui m’offre l’opportunité de renforcer l’expertise existante de Stonehage Fleming. Je me réjouis de travailler avec nos familles pour les aider à identifier les solutions appropriées dans cet environnement complexe et évolutif ».

POUR EN SAVOIR PLUS, CONTACTEZ

Montfort Communications

Toto Reissland / Pippa Bailey

T : +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming announces appointment of Mario Schoeman

Mario will be responsible for leading the distribution of Stonehage Fleming’s global service offerings, including the award winning Global Best Ideas Equity fund into the South African investment market, directly as well as through the Feeder Fund. He will be based in Stonehage Fleming’s Cape Town office and will report into Andrew Clarke, Group Head of Business Development. His appointment is effective immediately.

Mario has more than two decades of local and international investment industry experience, ranging from fund research and investment product management to retail and institutional business development. He was Head of Retail Distribution at Foord Asset Management for the past 10 years and served on various committees at the Association for Savings & Investment South Africa. Prior to this he was with OMIGSA and STANLIB in executive positions. Mario holds a BSc degree from the University of Stellenbosch as well as a Masters degree in Business Leadership from the University of South Africa.

Commenting on the appointment, Andrew Clarke said: “The Global Best Ideas Equity investment strategy is already well established in South Africa, but we look forward to having a dedicated resource on the ground who has the primary responsibility of growing the AUM of this fund through the wholesale market. We are excited about Mario’s experience in the industry and the role he will play in the distribution of our other premier offerings in the local market. We are delighted to welcome him to the firm.”

Mario Schoeman said: “Stonehage Fleming’s reputation in the industry is flawless and I am honoured to join the team. I am very excited about the team’s capabilities, evidenced in the track record of the GBI strategy and look forward to contribute to even more success.”

Stonehage Fleming announces series of new appointments in Jersey

Stonehage Fleming, one of the world’s leading international Family Offices, announces a series of appointments across its Family Office, Treasury and Corporate Services divisions in Jersey.

The eight new hires follow the recent announcement of Bev Stewart as Director in the Jersey Family Office division (November 2020) and cover various levels of seniority. New joiners include: Miguel Loureiro and Florence Busel in Family Office, Amber Thomas, Marta Szyman, Jarek Wolak and Matthew Bree in Treasury, and Jon Manning and Kay Jeanne in Corporate Services. They are all based in Stonehage Fleming’s Jersey office and their appointments are effective immediately.

The new appointments join an office of over 100 people, with nearly half of the partners having been at the firm for more than 20 years, and many of the senior team considered leading figures in their respective fields on the island.

Commenting on the appointment, Ana Ventura, Partner and Head of Family Office Jersey said: “We are thrilled to welcome so many new faces to our already extremely talented and dedicated team. These appointments reflect and confirm our drive to nurture talent and to provide unrivalled career development opportunities on the island.”

“As we celebrate International Women’s Day, it is equally exciting that we have hired some immensely promising female talent to join our existing group of women who we have supported through the firm’s ranks.”

Cora Binchy, Partner in Stonehage Fleming’s Family Office division said: “I am delighted to welcome everyone to Stonehage Fleming. I have been with the firm for over 30 years and am incredibly proud of the nurturing culture and career development opportunities Stonehage Fleming is able to provide. Likewise, a diverse workforce is essential for businesses and gender parity is a huge part of that. We have seen progress in this area but in a rapidly changing world, we need to accelerate so we are well positioned for the future. I look forward to working with our new colleagues.”

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Pippa Bailey

T: +44 (0)203 770 7913

Stonehage Fleming appoints new client relationship director in UK family office team

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Doris Sommavilla as Client Relationship Director, in the UK Family Office team.

Doris will draw on her family governance and succession planning experience to advice families on their strategic planning, and work closely with them to co-ordinate their operational requirements. She will be based in Stonehage Fleming’s London office and will report into Roelof Botha, Head of UK Family Office. Her appointment is effective immediately.

Doris joins from Blu Family Office where she was a Principal responsible for providing investment advice on alternative assets and for business development in the UK, Italy, Germany and Monaco. She is a third-generation member of a family business focused on hospitality and residential development in Italy and Eastern Europe, and Non- Executive Director of her family business.

Doris has over a decade of experience in investment management dealing with alternative investments with a focus on distressed opportunities in the UK, Germany, Italy and Eastern Europe. She began her career in institutional asset management, first with Allianz Global Investors in Milano, Italy and then Pimco in Munich, Germany.

Doris is a qualified family officer in Italy and CAIA charterholder, a full Member (MCSI) of the Chartered Institute for Securities & Investment (CISI), and has a Msc in Finance from Bocconi University, Italy. Doris is also the co-founder of Family Hippocampus, a global network of family members, and ambassador of the women chapter of Leaders First, a global membership organisation.

Commenting on the appointment, Roelof Botha, Head of UK Family Office, said: “It is a pleasure to welcome Doris to Stonehage Fleming. She has extensive experience in a wide range of Family Office services, including Family Governance and Succession matters, and has an impressive network of family relationships throughout the UK and Continental Europe, including in particular her native Italy. Her appointment demonstrates our commitment to the further growth of the business, and our ambition to lead the industry in the provision of services that support multigenerational families and wealth creators.”

Doris Sommavilla, said: “I have known Stonehage Fleming for many years, and admire its company culture and family-centred approach which sits at the core of the Group. I am passionate about helping families plan for succession and become resilient now and for future generations, and look forward to working with the team.

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming appoints wholesale business development director

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Steven Brown as Director of Group Business Development. Steven will be responsible for leading the distribution of Stonehage Fleming’s flagship Global Best Ideas Equity fund, into the UK wholesale market.

He will be based in Stonehage Fleming’s London office and will report into Andrew Clarke, Group Head of Business Development and work closely with Gerrit Smit, the fund manager and his team. His appointment is effective immediately.

Steven was previously a Wholesale and Discretionary Sales Director at Merian Global Investors, responsible for the sales and management of the firm’s relationships with the largest UK clients, including Asset Managers, Banks and Regional Wealth Managers. He joined Merian Global Investors as Head of Strategic Partnerships in 2012. Prior to that he was Head of UK Wholesale – Global Banking & Markets at RBS and managed the distribution of their multi-asset fund range in the UK wholesale market. He began his career at M&G Investments and Principal Global Investors.

Commenting on the appointment, Andrew Clarke, Group Head of Business Development said: “The Global Best Ideas Equity investment strategy already has a proven record with Stonehage Fleming’s investor families and the institutional investment community. Our team would like to build on this momentum and expand and accelerate activities in the UK wholesale arena. Steven’s experience in senior business development roles means he is well qualified to lead our distribution in this important market and we are delighted to welcome him to the firm.”

Steven Brown, said: “I am extremely pleased to be joining the firm to champion the further expansion of the Global Best Ideas Equity Fund amongst the wholesale investment community in the UK. We have a very strong story to tell and I am looking forward to working with Gerrit Smit and the investment team to bring this powerful offering to a wider audience.”

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming appoints Group Head of Business Development

Stonehage Fleming announces the appointment of Andrew Clarke as Group Head of Business Development.

Andrew will be responsible for leadership of business development across the Group. He will be based in Stonehage Fleming’s London office and report into Chris Merry, Group CEO.

Over the last 27 years, Andrew has gained extensive experience of working in senior business development roles within the wealth management sector, most recently with XY, an international group specialising in strategy consulting services and the control of large estates for ultra high net worth multigenerational families, where he was Executive Director based in the London office.

Prior to XY, Andrew led the business development effort at Deutsche Bank Wealth Management and Barclays Wealth in London - as Head of Professional Practices - focusing on winning ultra high net worth clients and family offices through his direct relationships and those via professional practices firms. Andrew began his career in the United States (New York) with the Merrill Lynch private client team. He has an MBA from the Cass Business School.

Commenting on the appointment, Chris Merry, CEO said: “We are excited to welcome Andrew as our Group Head of Business Development. Andrew has had an impressive career and his experience of working in senior business development roles within the wealth management sector makes him the ideal candidate for this important role within the Group. His appointment demonstrates our commitment to the further growth of the business, and our ambition to lead the industry in the provision of services that support multigenerational families and wealth creators.”

Andrew Clarke, said: “I am very pleased to join the firm, which I have known of for many years and respected for its approach to the market and supporting clients to plan and reach their objectives. I look forward to enhancing the growth of the business.”

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming appoints Director in Jersey Family Office team

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Bev Stewart as Director in the Jersey Family Office Division.

Bev will be responsible for managing a number of international high-net-worth client relationships, working with their families and advisers around the globe, assisting them with the management and coordination of their day-to-day and long-term financial needs.

She is based in Stonehage Fleming’s Jersey office and reports to Ana Ventura, Head of Family Office Jersey.

With over 16 years’ investment banking and financial services experience, Bev joins Stonehage Fleming from Absa Bank Limited in South Africa (formerly part of the Barclays’ group), where she served as a Director in the Investment Banking Global Finance team, joining in 2011. Bev led a team of bankers and was part of the senior management team responsible for a c.£4 billion loan book, and new business origination.

Bev trained as an accountant at PricewaterhouseCoopers in South Africa, later moving to the firm’s New York office following qualification. She returned to South Africa to join Bravura, a boutique corporate advisory firm in 2008. Bev is a member of the South African Institute of Chartered Accountants (SAICA) and STEP affiliate, with post graduate diplomas in Corporate Law and Tax Law.

Commenting on the appointment, Ana Ventura, Partner and Head of Family Office Jersey said: “I am thrilled to welcome Bev to Stonehage Fleming. She brings extensive experience to our already existing talented and dedicated team. We have seen an increased demand for services that facilitate internationally mobile multigenerational families and wealth creators who are becoming leading families of the future. Her appointment reflects the importance of our continued role as their most trusted advisers.”

Bev Stewart said: “I am delighted to join Stonehage Fleming and work alongside such a talented team. I have been impressed by the Group’s culture of excellence and high quality in everything it does. They are true pioneers within the family office industry, and I look forward to working with my new colleagues.”

Stonehage Fleming launches UK advisory board

Stonehage Fleming, one of the world’s leading international Family Offices, today launches its UK Advisory Board with the appointment of Lord (Robin) Renwick as its Chairman, Natalie Campbell and Anthony Wreford.

Lord Renwick was a senior diplomat who served as British Ambassador to the USA and South Africa. He was a crossbench peer in the House of Lords until 2018. He brings with him a wealth of board experience, having sat on many boards including Richemont AG, SAB Miller plc, British Airways plc. He is a former member of the Stonehage Fleming Group Board.

Natalie Campbell is a social entrepreneur who founded A Very Good Company in 2011 to put purpose, sustainability and inclusion into businesses. She is currently CEO of Belu Water and a board member for the London Economic Action Partnership and the Old Oak and Park Royal Development Corporation (OPDC).

Anthony Wreford, formerly Deputy Chairman of Omnicom Europe and President of the MCC, brings extensive communication, marketing and sports experience. He holds a variety of non-executive appointments including FPE Capital and Portas Consulting.

Chris Merry, Group Chief Executive Officer of Stonehage Fleming, says: “I am pleased to announce the launch of the Stonehage Fleming UK Advisory Board, in what is an exciting new development for our business. Our accomplished members will bring an independent view to our client proposition, products and services to ensure that we continue to evolve our offering to meet the needs of our global client base.

“We are fortunate to have secured the services of Robin, Natalie and Anthony, and I am looking forward to working closely with them.”

Further board appointments will be announced in due course.

Stonehage Fleming appoints wholesale business development director

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Steven Brown as Director of Group Business Development. Steven will be responsible for leading the distribution of Stonehage Fleming’s flagship Global Best Ideas Equity fund, into the UK wholesale market.

He will be based in Stonehage Fleming’s London office and will report into Andrew Clarke, Group Head of Business Development and work closely with Gerrit Smit, the fund manager and his team. His appointment is effective immediately.

Steven was previously a Wholesale and Discretionary Sales Director at Merian Global Investors, responsible for the sales and management of the firm’s relationships with the largest UK clients, including Asset Managers, Banks and Regional Wealth Managers. He joined Merian Global Investors as Head of Strategic Partnerships in 2012. Prior to that he was Head of UK Wholesale – Global Banking & Markets at RBS and managed the distribution of their multi-asset fund range in the UK wholesale market. He began his career at M&G Investments and Principal Global Investors.

Commenting on the appointment, Andrew Clarke, Group Head of Business Development said: “The Global Best Ideas Equity investment strategy already has a proven record with Stonehage Fleming’s investor families and the institutional investment community. Our team would like to build on this momentum and expand and accelerate activities in the UK wholesale arena. Steven’s experience in senior business development roles means he is well qualified to lead our distribution in this important market and we are delighted to welcome him to the firm.”

Steven Brown, said: “I am extremely pleased to be joining the firm to champion the further expansion of the Global Best Ideas Equity Fund amongst the wholesale investment community in the UK. We have a very strong story to tell and I am looking forward to working with Gerrit Smit and the investment team to bring this powerful offering to a wider audience.”

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming appoints Group Head of Business Development

Stonehage Fleming announces the appointment of Andrew Clarke as Group Head of Business Development.

Andrew will be responsible for leadership of business development across the Group. He will be based in Stonehage Fleming’s London office and report into Chris Merry, Group CEO.

Over the last 27 years, Andrew has gained extensive experience of working in senior business development roles within the wealth management sector, most recently with XY, an international group specialising in strategy consulting services and the control of large estates for ultra high net worth multigenerational families, where he was Executive Director based in the London office.

Prior to XY, Andrew led the business development effort at Deutsche Bank Wealth Management and Barclays Wealth in London - as Head of Professional Practices - focusing on winning ultra high net worth clients and family offices through his direct relationships and those via professional practices firms. Andrew began his career in the United States (New York) with the Merrill Lynch private client team. He has an MBA from the Cass Business School.

Commenting on the appointment, Chris Merry, CEO said: “We are excited to welcome Andrew as our Group Head of Business Development. Andrew has had an impressive career and his experience of working in senior business development roles within the wealth management sector makes him the ideal candidate for this important role within the Group. His appointment demonstrates our commitment to the further growth of the business, and our ambition to lead the industry in the provision of services that support multigenerational families and wealth creators.”

Andrew Clarke, said: “I am very pleased to join the firm, which I have known of for many years and respected for its approach to the market and supporting clients to plan and reach their objectives. I look forward to enhancing the growth of the business.”

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming appoints Director in Jersey Family Office team

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Bev Stewart as Director in the Jersey Family Office Division.

Bev will be responsible for managing a number of international high-net-worth client relationships, working with their families and advisers around the globe, assisting them with the management and coordination of their day-to-day and long-term financial needs.

She is based in Stonehage Fleming’s Jersey office and reports to Ana Ventura, Head of Family Office Jersey.

With over 16 years’ investment banking and financial services experience, Bev joins Stonehage Fleming from Absa Bank Limited in South Africa (formerly part of the Barclays’ group), where she served as a Director in the Investment Banking Global Finance team, joining in 2011. Bev led a team of bankers and was part of the senior management team responsible for a c.£4 billion loan book, and new business origination.

Bev trained as an accountant at PricewaterhouseCoopers in South Africa, later moving to the firm’s New York office following qualification. She returned to South Africa to join Bravura, a boutique corporate advisory firm in 2008. Bev is a member of the South African Institute of Chartered Accountants (SAICA) and STEP affiliate, with post graduate diplomas in Corporate Law and Tax Law.

Commenting on the appointment, Ana Ventura, Partner and Head of Family Office Jersey said: “I am thrilled to welcome Bev to Stonehage Fleming. She brings extensive experience to our already existing talented and dedicated team. We have seen an increased demand for services that facilitate internationally mobile multigenerational families and wealth creators who are becoming leading families of the future. Her appointment reflects the importance of our continued role as their most trusted advisers.”

Bev Stewart said: “I am delighted to join Stonehage Fleming and work alongside such a talented team. I have been impressed by the Group’s culture of excellence and high quality in everything it does. They are true pioneers within the family office industry, and I look forward to working with my new colleagues.”

Stonehage Fleming launches UK advisory board

Stonehage Fleming, one of the world’s leading international Family Offices, today launches its UK Advisory Board with the appointment of Lord (Robin) Renwick as its Chairman, Natalie Campbell and Anthony Wreford.

Lord Renwick was a senior diplomat who served as British Ambassador to the USA and South Africa. He was a crossbench peer in the House of Lords until 2018. He brings with him a wealth of board experience, having sat on many boards including Richemont AG, SAB Miller plc, British Airways plc. He is a former member of the Stonehage Fleming Group Board.

Natalie Campbell is a social entrepreneur who founded A Very Good Company in 2011 to put purpose, sustainability and inclusion into businesses. She is currently CEO of Belu Water and a board member for the London Economic Action Partnership and the Old Oak and Park Royal Development Corporation (OPDC).

Anthony Wreford, formerly Deputy Chairman of Omnicom Europe and President of the MCC, brings extensive communication, marketing and sports experience. He holds a variety of non-executive appointments including FPE Capital and Portas Consulting.

Chris Merry, Group Chief Executive Officer of Stonehage Fleming, says: “I am pleased to announce the launch of the Stonehage Fleming UK Advisory Board, in what is an exciting new development for our business. Our accomplished members will bring an independent view to our client proposition, products and services to ensure that we continue to evolve our offering to meet the needs of our global client base.

“We are fortunate to have secured the services of Robin, Natalie and Anthony, and I am looking forward to working closely with them.”

Further board appointments will be announced in due course.